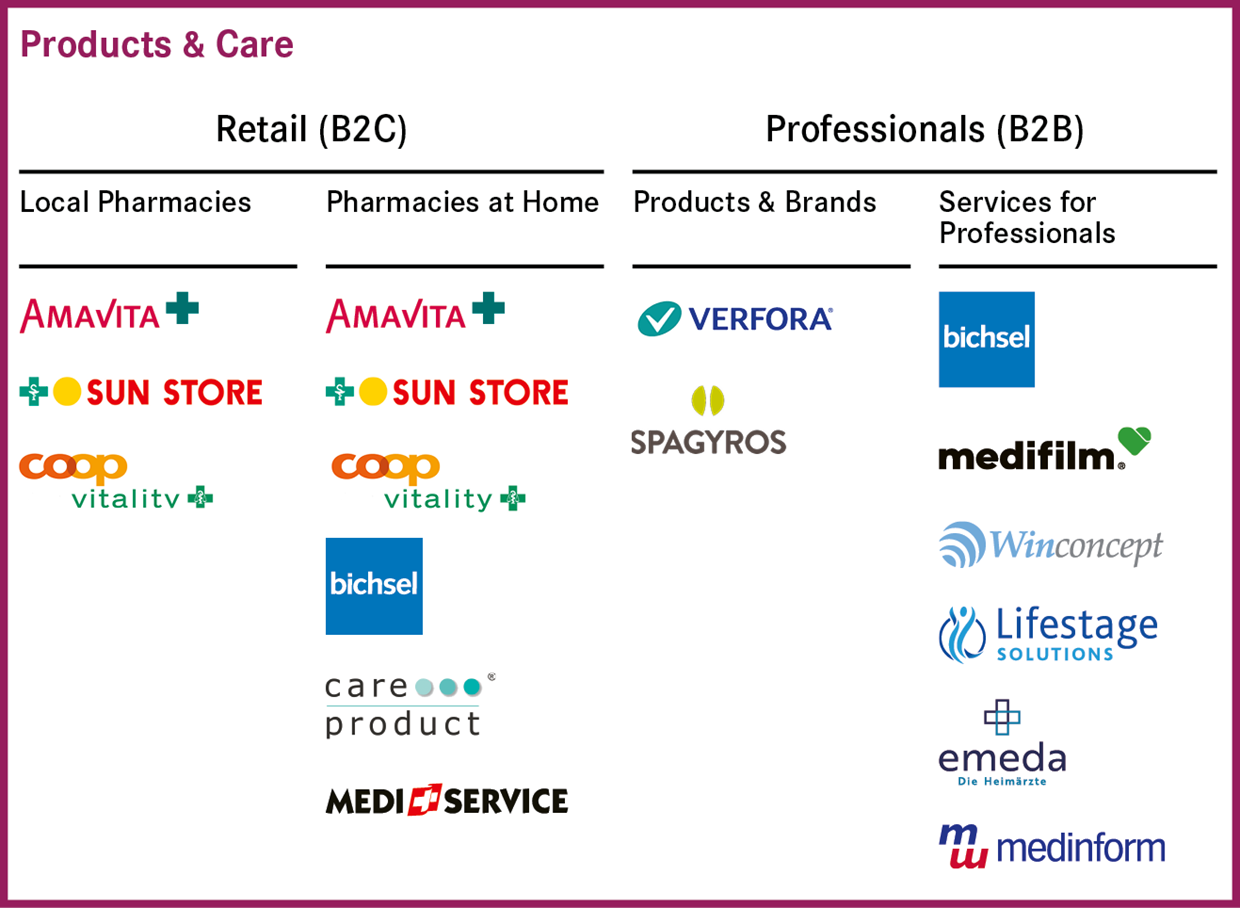

«Products & Care» segment

The «Products & Care» segment comprises the «Retail» business area with offerings for patients and end customers (B2C) and the «Professionals» business area with offerings for business customers and healthcare partners (B2B).

The «Retail» business area comprises the two sectors «Local Pharmacies» (POS) and «Pharmacies at Home» (mail-order and home care), while the «Professionals» business area comprises the «Products & Brands» and «Services for Professionals» sectors.

These activities focus on developing and marketing healthcare services and products via different sales channels: On the one hand, directly to end customers (B2C) through a strong presence with its own bricks-and-mortar pharmacies or at home with home-care services, mail-order pharmacies and e-shops. On the other hand, as an effective partner of service providers (B2B) in the healthcare sector, such as pharmacies, drug stores, doctors, care homes, home-care organisations and hospitals.

Key figures «Products & Care» segment

Net sales and operating result

The «Products & Care» segment generated net sales of CHF 986.8 million (+7.4%) in the first half of 2022. Of this, CHF 880.4 million (+5.5%, excluding Coop Vitality) was attributable to the «Retail» (B2C) business area and CHF 109.3 million (+23.5%) to the «Professionals» (B2B) business area.

The adjusted¹ operating result (EBIT), i.e. excluding the impact of the IFRS 16 (Leases) accounting standard, amounted to CHF 75.8 million in the first half of 2022, compared with CHF 76.2 million in the same period last year, which corresponds to a reduction of 0.5%. The adjusted¹ return on sales (ROS) fell from 8.3% to 7.7%. Reported EBIT remained practically unchanged from the previous year at CHF 77.6 million (previous year CHF 77.7 million). Adjusted for the EBIT contributions from extraordinary additional sales in connection with COVID-192, the «Products & Care» segment achieved strong adjusted¹ EBIT growth of 20.9% year-on-year.

EBIT increased in the reporting period due to higher sales in pharmacies at high-frequency locations as well as the more intense flu epidemic and numerous illnesses caused by the coronavirus Omicron variant compared to the previous year. The expansion also contributed to EBIT growth. These positive effects almost fully compensated for the sharp decline in extraordinary additional sales generated through offers to combat the COVID-192 pandemic.

1) Excluding the effects of IFRS 16. See chapter «Alternative performance measures».

2) Sales of COVID-19 initiatives with PCR, antigen, rapid and self-testing as well as vaccinations, EBIT contributions estimated.

«Retail» business area (B2C)

Net sales development

In the first half of 2022, the «Retail» business area generated net sales of CHF 880.4 million (+5.5%, excluding Coop Vitality). Of this, CHF 627.9 million (+1.8%) was attributable to «Local Pharmacies» (POS) and CHF 252.6 million (+16.1%) to «Pharmacies at Home» (mail-order and home care). Adjusted for extraordinary additional sales from COVID-19 initiatives1, sales growth amounted to 10.3%.

Government-mandated price reductions caused sales to decline by -2.0% during the reporting period. Excluding this effect, net sales in the «Retail» business area would have risen by 7.5%.

By way of comparison, sales of medications from bricks-and-mortar and mail-order pharmacies in Switzerland (prescription [Rx] and OTC products) grew by 8.5% in the reporting year (IQVIA, Pharmaceutical Market Switzerland, 2022).

Progress in integrated and networked healthcare

By investing in the Well digital healthcare platform, Galenica is further advancing integrated and networked healthcare in Switzerland and linking Well’s digital services with its own digital and in-person offerings. The Well app makes it even easier for customers to access existing Galenica services. In a first step, booking of vaccination appointments was integrated or other pharmacy healthcare services like heart or allergy checks. Well also supports healthcare professionals, as it gives them the option to connect the functionalities and data to their existing systems and thus allocate appointments via Well and to use health data that patients make available to them via the app.

«Local Pharmacies» sector

In the first half of 2022, the «Local Pharmacies» sector generated net sales of CHF 627.9 million (+1.8%, excluding Coop Vitality). Adjusted for extraordinary additional sales from COVID-19 initiatives1, sales growth amounted to 7.5%.

The main drivers of revenue growth in the «Local Pharmacies» sector were higher sales from pharmacies in high-frequency locations and and higher sales of OTC cold medicines.

The expansion of the pharmacy network accounted for 1.0% of the sales growth.

Government-mandated price reductions caused sales to decline by -1.2% during the reporting period. Excluding this effect, net sales in the «Local Pharmacies» sector would have risen by 3.0%.

By way of comparison, sales of medications from bricks-and-mortar pharmacies in Switzerland (prescription [Rx] and OTC products) grew by 8.5% in the reporting year (IQVIA, Pharmaceutical Market Switzerland, 2022). The consumer healthcare market grew by 6.4% year-on-year (IQVIA, Consumer Health Market Switzerland, first half of 2022, excluding COVID-19 self-tests).

1) Sales of COVID-19 initiatives with PCR, antigen, rapid and self-testing as well as vaccinations.

Sustainable generic substitution rate

As of 30 June 2022, Galenica was able to increase its generic substitution rate to around 75%, an increase of 1.5 percentage points compared to the end of 2021. As a result, Galenica’s contribution to reducing price increases in the Swiss healthcare system will continue to make an impact in the long term.

The pharmacy as an expert health partner

In the period under review, pharmacies were able to further strengthen their role as expert health partners and the first point of contact for health issues. They did this by training additional pharmacy staff in the range of services and advice on offer and strengthening the expertise available in the pharmacies. The current 31 algorithms to support the diagnosis of common complaints are constantly being expanded on an ongoing basis. In addition, there are plans to integrate telemedicine services into the service portfolio and offer laboratory analyses to optimise pharmacy advice. In the first half of 2022, around 43,000 customers made use of the range of services and advice available to assist with resolving health complaints. Compared to the first half of 2021, utilisation of this range of services and advice increased by an impressive 58% (previous year: 27,000 customers). SWICA, one of Switzerland’s largest health insurers, has been paying for the services provided by pharmacies under its «Favorit Medpharm» insurance model since the beginning of June 2022, thus supplementing the remuneration benefits provided by CSS, which has been paying pro rata for the services provided by pharmacies under its «myFlex» supplementary outpatient insurance policy since the beginning of 2022.

«Omni-Channel» strategy shows success

In the first half of 2022, increased investments were made to improve the visibility of the Amavita, Sun Store and Coop Vitality online shops in digital channels, such as search engines, and customer purchasing behaviour was examined. The visibility of pharmacy online shops grew by 16.5% in the period under review. Compared to the first half of 2021, 20% more customers visited a bricks-and-mortar pharmacy following a web shop visit. The consistent linking of online and offline channels is therefore showing significant success and reinforcing Galenica’s «omni-channel» approach.

Further optimisation of the pharmacy network

In the first half of 2022, Galenica further optimised and expanded its pharmacy network. With a net plus of four pharmacies, it comprised 372 own-held pharmacies as of 30 June 2022.

Overview of development of the pharmacy network

|

|

30.06.2022 |

31.12.2021 |

Change |

|

Amavita pharmacies 1) |

182 |

181 |

+1 |

|

Sun Store pharmacies 1) |

94 |

92 |

+2 |

|

Coop Vitality pharmacies 2) |

89 |

88 |

+1 |

|

Specialty pharmacy Mediservice 1) |

1 |

1 |

– |

|

Majority holdings in other pharmacies 1) |

6 |

6 |

– |

|

Total own points of sale |

372 |

368 |

+4 |

1) Fully consolidated

2) Consolidated at equity

«Pharmacies at Home» sector

With sales of CHF 252.6 million (+16.1%), the «Pharmacies at Home» sector once again achieved exceptionally strong growth. The strong performance was driven particularly by the specialty pharmacy Mediservice with new medications to treat rare diseases in combination with home care services (+16.2%). Bichsel’s home care sales in the area of clinical nutrition also developed positively (+5.0%). On the other hand, sales generated by the Amavita and Sun Store online shops declined compared to the exceptionally strong prior-year period during the lockdown (-12.5%). In addition, a one-off shift in segment reporting had a positive impact on growth. Without this special effect, the growth of «Pharmacies at Home» would have been 11.3%.

Government-mandated price reductions caused sales to decline by -4.3% during the reporting period. Excluding this effect, net sales in the «Pharmacies at Home» sector would have risen by 20.4%.

By way of comparison, sales of medications from mail-order pharmacies in Switzerland (prescription [Rx] and OTC products) grew by 8.2% in the reporting year (IQVIA, Pharmaceutical Market Switzerland, 2022).

Article 71a-d HIO

In exceptional cases, Article 71a-d HIO provides for the reimbursement of medicinal products or their indications that are not included in the federal specialities list (SL). This regulation is relevant, for example, in cases of rare, very severe or chronic disease and high therapeutic benefit. SmartMIP is already in use at 23 health insurance providers and 19 pharmaceutical companies.

More efficient digital collaboration

In the first half of 2022, a further step was taken towards fostering more efficient digital collaboration with health insurers. In early July 2022, Galenica acquired 100% of Aquantic Ltd. The IT and consulting company offers software solutions that act as an interface between pharmaceutical companies and health insurers when it comes to the reimbursement of medicinal products. Aquantic's SmartMIP software solution makes it possible for medicinal products, within the meaning of Article 71 a-d of the Health Insurance Ordinance (HIO), to be reimbursed quickly, in a standardised manner and in compliance with the law. Aquantic’s solution and extensive experience will enable Mediservice to expand its Article 71 expertise and optimise its services. Patients of Mediservice and partner companies benefit from the digitalisation of processes in connection with Article 71 and the associated quality and efficiency.

In recent months, Mediservice has also developed new digital services for patient care at home. Mediservice operates via an app to support patients with their therapy, thereby improving the adherence, success, satisfaction and quality of life of patients.

«Professionals» business area (B2B)

Net sales development

In the first half of 2022, the «Professionals» business area generated net sales of CHF 109.3 million (+23.5%). Of this, CHF 75.1 million (+26.0%) was attributable to «Products & Brands» and CHF 34.2 million (+18.3%) to «Services for Professionals».

«Products & Brands» sector

The «Products & Brands» sector generated sales of CHF 75.1 million (+26.0%) in the first half of 2022. Of this, CHF 62.4 million (+34.4%) came from the Swiss market and CHF 12.7 million (-3.4%) from exports involving distribution partners. Sales in the «Products & Brands» sector were driven by the more intense flu season compared to the same period in the previous year, numerous illnesses caused by the coronavirus Omicron variant and increased sales of travel-related products. In addition, the expansion of the product portfolio in 2021 with the acquisition of the therapeutic product range from Dr. Wild and the acquisition of Spagyros made a positive 13.0% contribution to sales growth.

By way of comparison, the consumer healthcare market grew by 6.4% year-on-year (IQVIA, Consumer Health Market Switzerland, first half of 2022, excluding COVID-19 self-tests).

Verfora expands its range of homeopathic products

At the end of June 2022, Verfora announced that it would be taking over the range of products produced by the manufacturer Boiron in Switzerland as of 1 October 2022. The company’s product portfolio particularly comprises homeopathic medications with indications as well as individual homeopathic remedies. Its best-known brand in Switzerland is Oscillococcinum®. The Boiron range of products excellently complements the existing complementary medicine portfolio of Verfora and Spagyros and significantly strengthens the company's offering in the field of homeopathy.

«Services for Professionals» sector

The «Services for Professionals» sector generated sales of CHF 34.2 million (+18.3%) in the first half of 2022. Growth was primarily due to the acquisition of Lifestage Solutions Ltd. in July 2021. Both Medifilm and Winconcept continued to perform strongly, each growing by around 10.0%. By contrast, temporary production challenges at the laboratories of the Bichsel Group led to backlogs and corresponding year-on-year sales losses.

Broader range of services for retirement and nursing homes

In the first half of 2022, Galenica and Medicall founded the joint venture Emeda, which aimed to provide medical and pharmaceutical care to retirement and nursing homes in Switzerland. The Emeda team consists of mobile doctors who specialise in outpatient geriatric medical care for residents of nursing homes. Galenica’s investment in this joint venture will expand and enhance the offering with the inclusion of pharmaceutical care for patients in homes. In the future, Emeda will be able to draw on the entire range of Galenica services, such as the provision of medicines, including blister packaging and pharmaceutical advice, for retirement and nursing homes.

Lifestage Solutions expands into French-speaking Switzerland

In the first half of 2022, Lifestage Solutions was able to expand its services and has now been able to acquire three nursing homes in French-speaking Switzerland as customers. In addition to Lifestage Solutions’s weighing system, which optimally manages stock-based care products, the nursing homes also use Lifestage Solutions’s wide range of digital services, making the process for ordering medical consumables, care products and services fully automated.

Winconcept successful with new partner model

In 2021, Winconcept developed and introduced a new three-stage partner model. Winconcept’s existing customers were migrated to this model in the first half of 2022. In the three-stage partner model, pharmacies can use the services offered by Winconcept as part of its small, medium and large packages. Thanks to the new partner model, Winconcept was able to acquire eleven new independent pharmacies as customers in the first six months of 2022. As of 30 June 2022, Winconcept serviced a total of 161 partner pharmacies in Switzerland.

Winconcept also took part in the «Pic & Collect» pilot project in the first half of the year. The project involves pharmacy customers taking a photo of their desired product with their mobile phone and sending it to the pharmacy via WhatsApp. After the confirmation by the pharmacy, the customer can pick up the ordered product in person.

Strategic partnership with Medinform

In order to ensure that the training and development of employees in pharmacies and the health advice they provide remains at a high level and continues to advance, Galenica expanded its existing partnership and acquired a stake of 50% in Medinform Ltd. as of 5 July 2022. Medinform is the leading provider of training and specialisations for pharmacies and has an extensive partner network of health insurers and doctors. Medinform currently offers 50 different FPH courses for pharmacists, pharmacy assistants and druggists. Galenica’s investment in the company means that it will be able to benefit from valuable synergies for the professional training of its employees.