Products & Care

The “Products & Care” segment comprises the “Retail” business area with offerings for patients and end customers (B2C) and the “Professionals” business area with offerings for business customers and partners in the healthcare industry (B2B).

The “Retail” business area comprises the two sectors “Local Pharmacies” (bricks-and-mortar pharmacies) and “Pharmacies at Home” (mail-order pharmacies and home care), while the “Professionals” business area consists of the “Products & Brands” and “Services for Professionals” sectors. Both business areas focus on the development, marketing and sale of services and products through the various Galenica distribution channels.Depending on their needs, end customers (B2C) can benefit from their own bricks-and-mortar pharmacies, home care services, mail-order pharmacies and online shops.

Galenica also supports healthcare providers (B2B) such as pharmacies, drugstores, physicians, care homes, hospitals and home care organisations as a strong partner.

“Products & Care” segment development

The “Products & Care” segment generated net sales of CHF 867.3 million (+4.6%) in the first half of 2025. Of this, CHF 731.1 million (+5.1%, excluding Coop Vitality and Mediservice) was attributable to the “Retail” business area (B2C) and CHF 140.9 million (+1.8%) to the “Professionals” business area (B2B).

Adjusted1 EBIT increased by 4.6% to CHF 79.5 million, while the EBIT margin remained unchanged at 9.2%. EBIT growth was dampened by a slightly lower gross margin due to a less favourable product mix. This effect was offset by a clear focus on personnel cost management in the “Retail” business sector.

1) Excluding the effects of IFRS 16. See chapter "Alternative performance measures"

“Retail” business area (B2C)

Local Pharmacies

In the first half of 2025, the “Local Pharmacies” sector generated net sales of CHF 693.1 million (+5.4%, excluding Coop Vitality). The expansion of the pharmacy network contributed 1.8% to sales growth. Adjusted for this expansion effect, Galenica pharmacies grew by 3.6% organically. Growth was driven by strong demand for prescription drugs, including GLP-1-based2 weight loss products and drugs related to the severe flu wave at the beginning of the year. In addition, sales of dietary supplements and dermatological products relating to sun protection also developed positively.

By way of comparison, drug sales from bricks-and-mortar pharmacies in Switzerland (prescription-only [Rx] and OTC products) grew by 5.2% in the reporting period (IQVIA, Pharmaceutical Market Switzerland, first half of 2025). The consumer healthcare market recorded year-on-year growth of 0.6%, with the non-drug segment growing by 0.8% (IQVIA, Consumer Health Market Switzerland, first half of 2025). The Galenica Group pharmacies thus performed more or less in line with the overall market.

2) GLP-1 stands for “Glucagon-like Peptide 1”, a hormone produced in the gut that plays an important role in regulating blood sugar levels

Everyday life in pharmacies remains dynamic

The bricks-and-mortar pharmacies of the Galenica Group can look back on a positive first half of 2025. Day-to-day work in the pharmacies remains dynamic and Galenica’s dedicated teams often take on a pioneering role. This is the case, for example, with the establishment of generics and biosimilars. Galenica has been doing important pioneering work in distributing and promoting the acceptance of generics for many years now. Nowadays, the cost-containment measure of dispensing generics instead of original preparations is established, and the Group is increasingly pursuing a similar approach to biosimilars, i.e., active substances manufactured using biotechnology that are highly similar in quality, safety and efficacy to the already approved biological reference medicinal products. Using biosimilars also helps to reduce the cost of healthcare.

The generic substitution rate declined slightly to 77.4% in the first half of 2025 (previous year: 79.2%). This development was mainly due to market-related factors such as temporary supply bottlenecks at individual manufacturers and the expiry of patent protection for a top-selling original preparation. Despite the slight decline, the generic substitution rate remains at a very high level. The Galenica Group thus continues to make a substantial contribution to limiting healthcare costs in Switzerland and reaffirms its role as a responsible stakeholder in the healthcare system.

Galenica focuses on continuous improvement

Lean management is another example of Galenica’s development-oriented approach. This method of continuous process improvement, which involves all employees, is a key principle throughout the company and has already been rolled out in more than half of the pharmacies. In view of the increasing responsibility of specialist personnel, for example as part of "Consultation plus" (see below), lean management is an important measure for employee satisfaction and greater customer focus.

Locations with strong sales acquired

In the first half of 2025, the Galenica network recorded net growth of five pharmacies (8 acquisitions, 3 restructurings). Attractive, high-turnover pharmacies were acquired in all language regions, such as in Würenlos (AG), Tavannes (BE) and Biasca (TI). A milestone was reached in March 2025: With the acquisition of a pharmacy in Centro Shopping Serfontana in Morbio Inferiore (TI), the number of Amavita pharmacies increased to 200. As of late June 2025, the Galenica pharmacy network comprised 381 locations throughout Switzerland.

Own sales points

|

|

30.06.2025 |

31.12.2024 |

Change |

|

Amavita pharmacies 1) |

201 |

198 |

+3 |

|

Sun Store pharmacies 1) |

86 |

85 |

+1 |

|

Coop Vitality pharmacies 2) |

86 |

86 |

– |

|

Specialty pharmacy Mediservice 2) |

1 |

1 |

– |

|

Majority holdings in other pharmacies 1) |

7 |

6 |

+1 |

|

Total own points of sale |

381 |

376 |

+5 |

1) Fully consolidated

2) Consolidated at equity

Undisputed importance of pharmacies in basic care

Every customer should receive in-depth pharmaceutical advice in one of the Galenica Group pharmacies if needed. This is the aim of the “Consultation plus” initiative, which Galenica has been consistently pursuing for several years, and which will be implemented in all Group pharmacies by late 2026. Demand for the healthcare services offered as part of the initiative such as preventive advice, support for acute complaints and vaccinations developed very positively in the first half of 2025. In particular, the number of vaccinations carried out in pharmacies against TBE, influenza, herpes zoster, pertussis and pneumococcus is growing. The importance of bricks-and-mortar pharmacies for low-threshold healthcare is supported by the political and regulatory environment: in March 2025, Parliament adopted cost containment package 2, which expands the remit of pharmacists in the areas of prevention and therapy support and lays the foundation for certain services to be covered by compulsory health insurance. Thanks to continuous investment in training, infrastructure and digital solutions, Galenica is ideally equipped for this change of course.

Digital platforms becoming increasingly important

In light of political developments, Galenica is seeing a continuing increase in interest among health insurers in innovative forms of collaboration, usually involving the digital platforms with which the Group cooperates, such as Well or Compassana. The popularity of another application, OneDoc, shows just how important it is to forge a connection between online and on-site presence: in over 90% of Galenica pharmacies, customers can book consultations or vaccination appointments via OneDoc. In the first four months of the current financial year, almost 40% of all vaccinations against tick-borne encephalitis (TBE) had already been registered via the platform.

Pharmacies at Home

The “Pharmacies at Home” sector contributed to the overall result with net sales of CHF 38.1 million (excluding Mediservice) and remained stable with sales growth of +0.3%.

Digital assistant: the Prescription Manager

The Amavita and Sun Store online shops recorded pleasing growth rates. Bichsel, a company specialising in clinical nutrition, also performed well. The first half of the year also featured a fine example of Galenica’s omni-channel approach: the Prescription Manager. The Prescription Manager is a digital assistant for people with chronic illnesses, who require a regular supply of multiple different medications or who have a repeat prescription. The Prescription Manager makes it easy to manage repeat prescriptions and convenient to re-order medications, either at home or in the pharmacy of choice. Since its launch at the beginning of the year, around 10,000 patients have used the application. Despite positive growth, the online share of the overall market remains relatively low.

New marketing mix focuses on expertise and relevance

Since September 2024, Stephan Mignot has been Head of Pharmacies Marketing, responsible for marketing the pharmacies and their services. He and his team have already made their mark this year with the reorientation of the communication tools. An important channel is the customer magazine, which is published five times a year, supplemented by newsletters and flyers. The newsletter and magazine in particular focus on imparting specialist knowledge. The focus is not on current offers, but rather on relevant topics curated by pharmaceutical experts. In addition, pharmacy shop windows will be used more strategically in future: The new shop window concept ensures a uniform and appealing look, showcases offers in the right light and creates an attractive presence for own or third-party brands.

“Professionals” business area (B2B)

Products & Brands

The “Products & Brands” division generated sales of CHF 97.8 million (+0.9%) in the first half of 2025. Of this, CHF 76.8 million (+5.3%) was generated in the Swiss market and CHF 21.0 million (-12.6%) in exports with distribution partners. Sales growth in the Swiss market was supported by Cooper Consumer Health products, for which Verfora has been responsible for distribution since the beginning of the year. Sales of Verfora products in Swiss pharmacies and drugstores exceeded the overall market with growth of 2.3%, leading to market share gains.

Organic sales growth in the “Products & Brands” segment, excluding the expansion effect (+5.4%), was -4.5% in the first half of the year. The decline in organic sales growth was mainly due to Verfora's export business, which saw exceptionally high sales in the previous year in connection with the one-off build-up of bridging stock inventories as a result of regulatory changes in the EU.

By comparison, the consumer healthcare market grew by 0.6% compared with the same period last year (IQVIA, Consumer Health Market Switzerland, first half of 2025).

Complementary medicine is popular

Since 1 January 2025, Verfora, the leader in the Swiss consumer health market, has been responsible for the exclusive marketing and distribution of Cooper Consumer Health products. The French dermacosmetics brand SVR is now also part of Verfora’s portfolio, helping Verfora to consolidate its already prominent market position. The company’s complementary medicine offerings continue to see strong demand. In particular, the Omni-Biotic® brand, with products that support intestinal health, achieved significant growth thanks to targeted marketing and sales activities. Galenica also focused on the further development of its strong brands such as Spagyros and Padma in the first half of 2025. Spagyros and Padma have been managed by CEO Michael Severus since 1 January 2025, resulting in improved coordination of marketing and sales activities and the exploitation of synergies. Spagyros also has reason to celebrate in 2025: the natural health specialist looks back on a 40-year history.

Services for Professionals

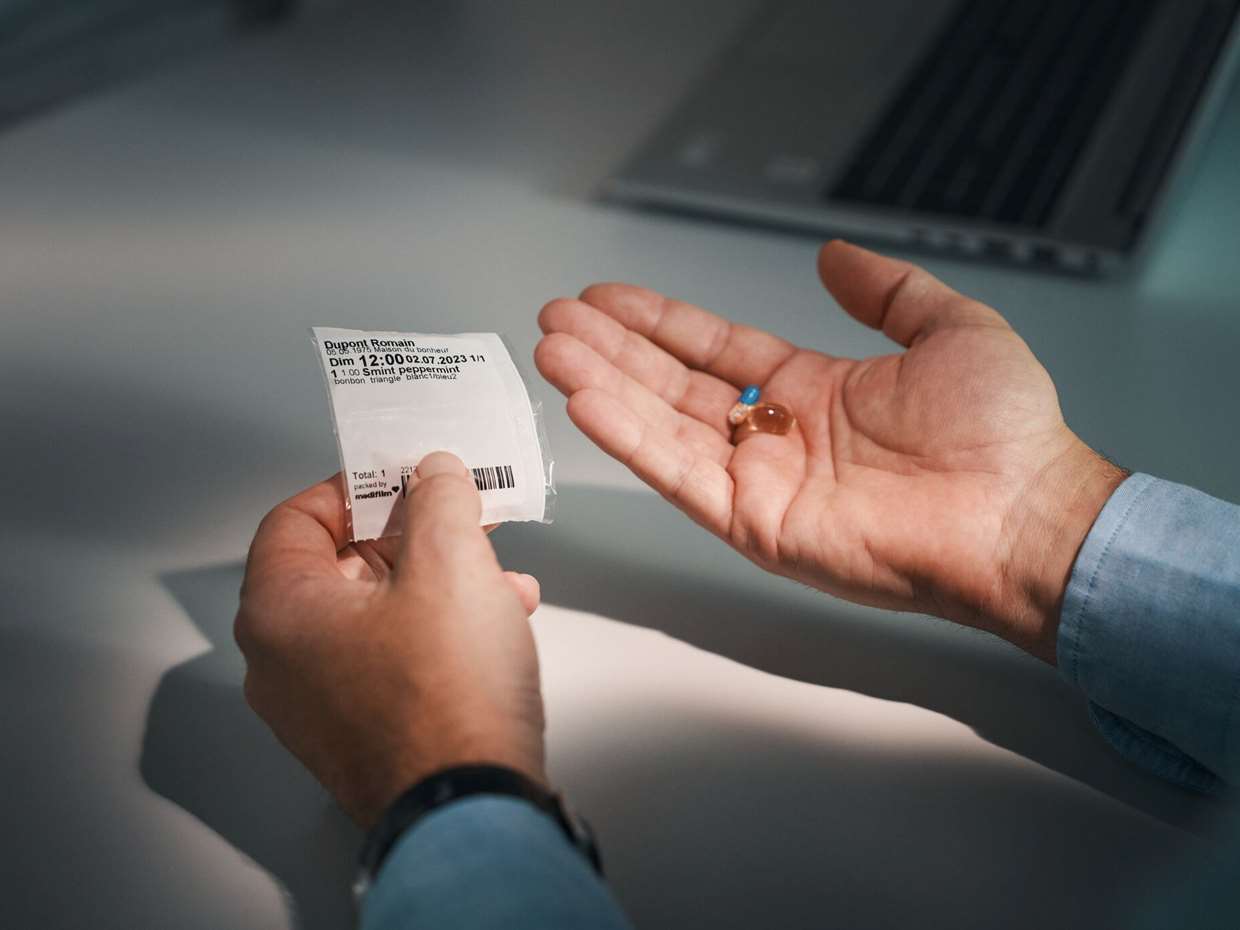

The “Services for Professionals” sector generated sales of CHF 43.1 million (+4.0%) in the first half of 2025. Growth was generated in particular by the strong performance of Lifestage Solutions, Bichsel’s production division and blister packaging solutions from Medifilm.

Integration of offers on the Lifestage platform

The “Services for Professionals” sector is a particularly good demonstration of how the Galenica network functions and adds value. The segment includes the specialist for clinical nutrition (Bichsel), patient-specific blister packaging of medications (Medifilm), a digital platform (Lifestage Solutions) and mobile care home doctors (Emeda) – complemented by a broad coverage of bricks-and-mortar pharmacies throughout Switzerland. Over the past few months, Galenica has been driving forward the integration of these diverse offerings. One example of this is the inclusion of Bichsel products on the Lifestage platform. Customers, in this case healthcare institutions, will benefit from even easier access to the services they need. Bichsel also successfully completed the Swissmedic audit for the renewal of its operating licence. For the company, this is an important confirmation of its high-quality standards in the field of clinical nutrition following a phase of targeted product adjustments and process optimisations.

New blister packaging machine in use

Blister packaging specialist Medifilm is expanding its capacity this year with the addition of another fully integrated blister packaging machine. Demand in the home care market is evident from the 10% increase in patient days. In the second half of the year, Medifilm will intensify its collaboration with a leading company in the field of housing for the elderly and implement targeted digitalisation measures for its cooperation with pharmacies. The aim is always to reduce the workload of nursing staff and pharmacy employees and contribute to increasing patient safety.